Interest Rate Swap Valuation (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

EXCEL DESCRIPTION

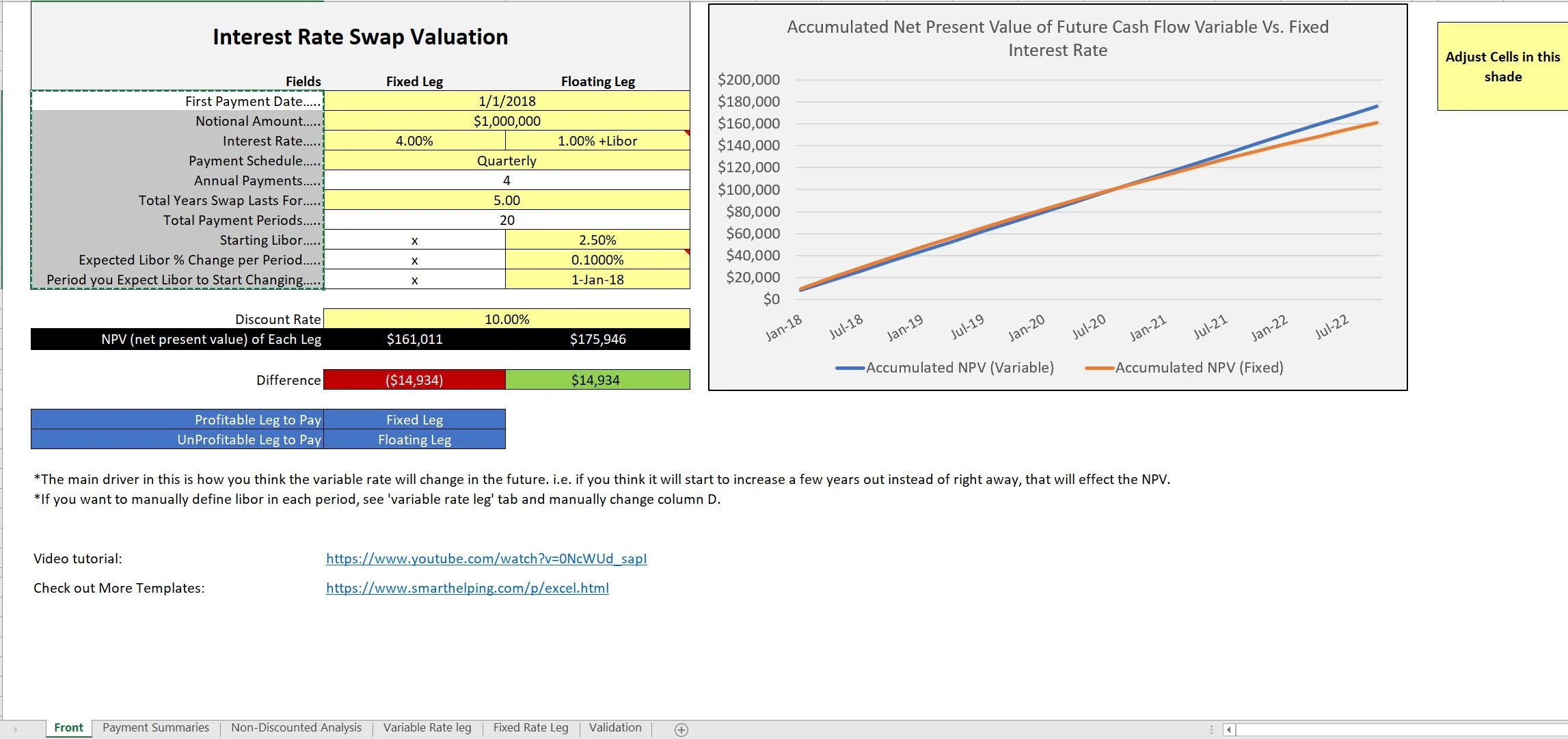

Interest rate swaps may seem scary, but both large and small entities do them all the time. It can be used as a hedge or as a bet about future interest rates. Many banks offer them as an investment vehicle. What you can do with this template is figure out the present value of both legs and get a better understanding of how this financial instrument works. Note, this does involve risk and doing such investments can result in monetary loss depending on how the future interest rates change.

A rate swap is considered a derivative contract that will have some value based on existing conditions and expectations about future conditions. They can be traded based on their terms rates sort of like stock option contracts where there is some expiration date and some future value remaining for a given contract.

This is a vanilla interest rate swap valuation calculator built in Excel. This kind of financial instrument is designed to let two parties pay each other interest rates based on some notional value.

One party will pay a fixed leg while the other pays a variable leg. Depending on how interest rates change over time, one of the legs is going to be valuable and the other not.

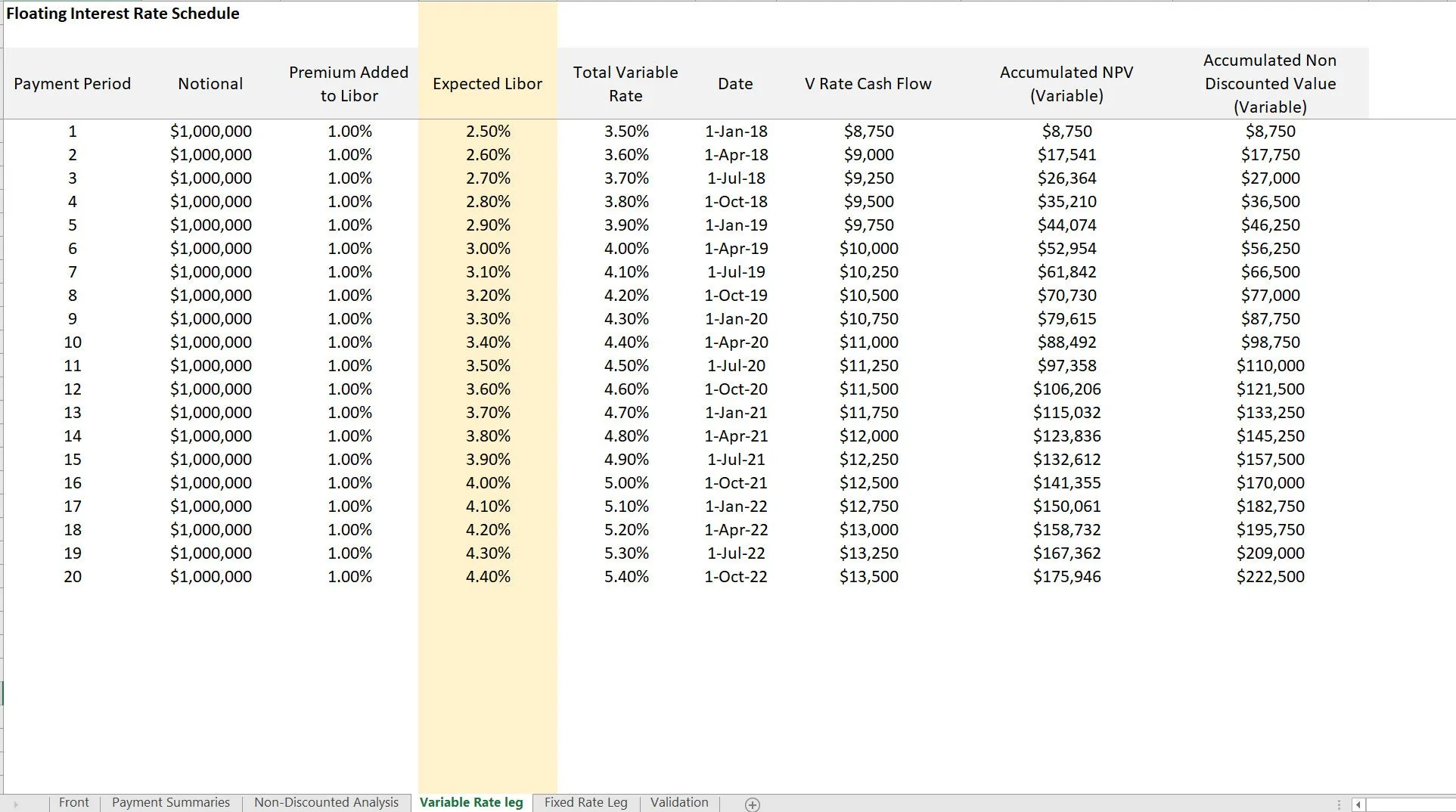

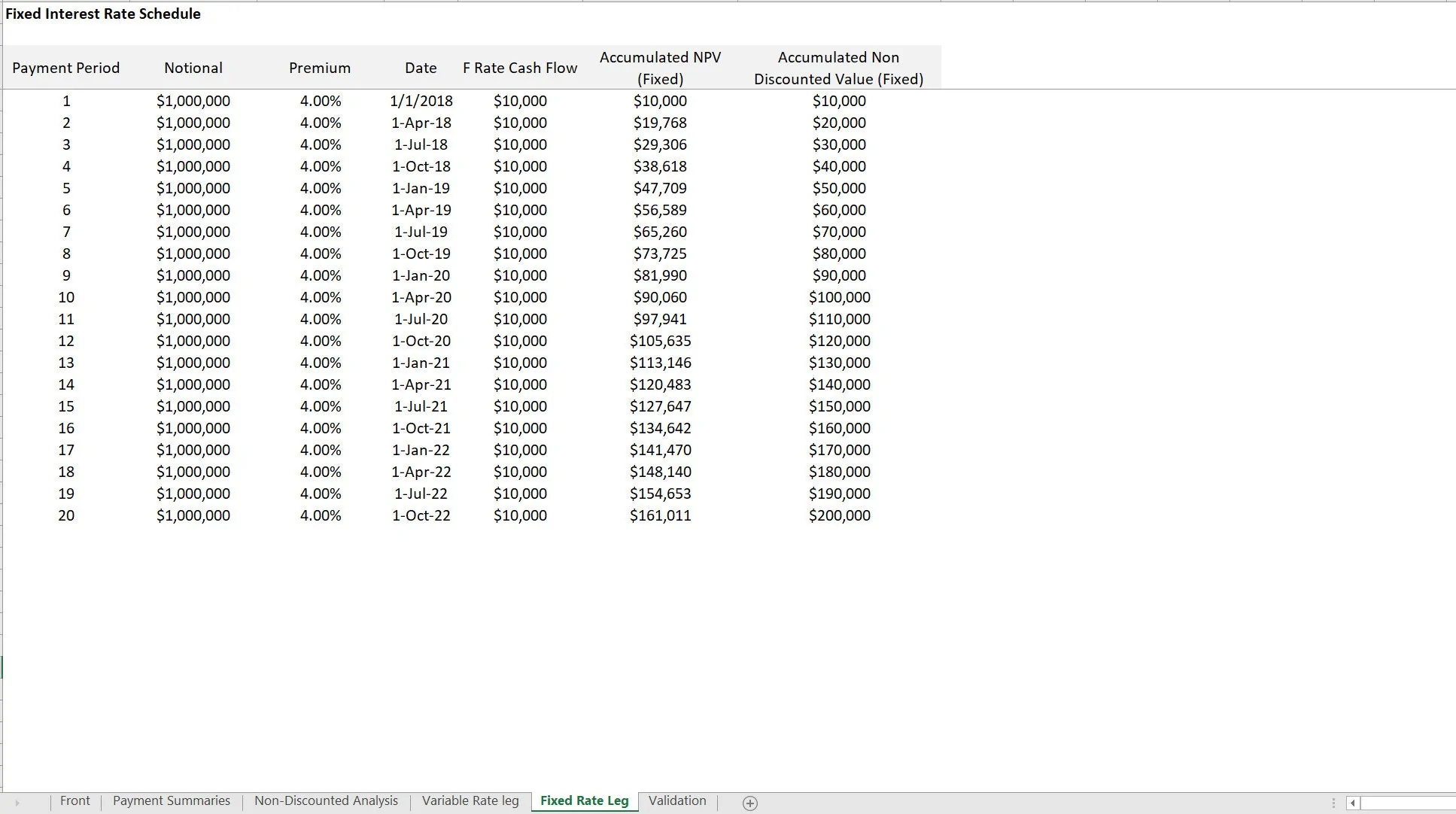

The model will show each payment over time based on all the dynamic assumptions and calculate which leg is more profitable given certain configurations of libor / future interest rates.

The primary inputs include:

• First Payment Date

• Notional Amount

• Interest Rate

• Payment Schedule

• Annual Payments (formula)

• Total Years Swap Lasts For

• Total Payment Periods (formula)

• Starting Libor

• Expected Libor % Change per Period

• Period you Expect Libor to Start Changing

Discount Rate

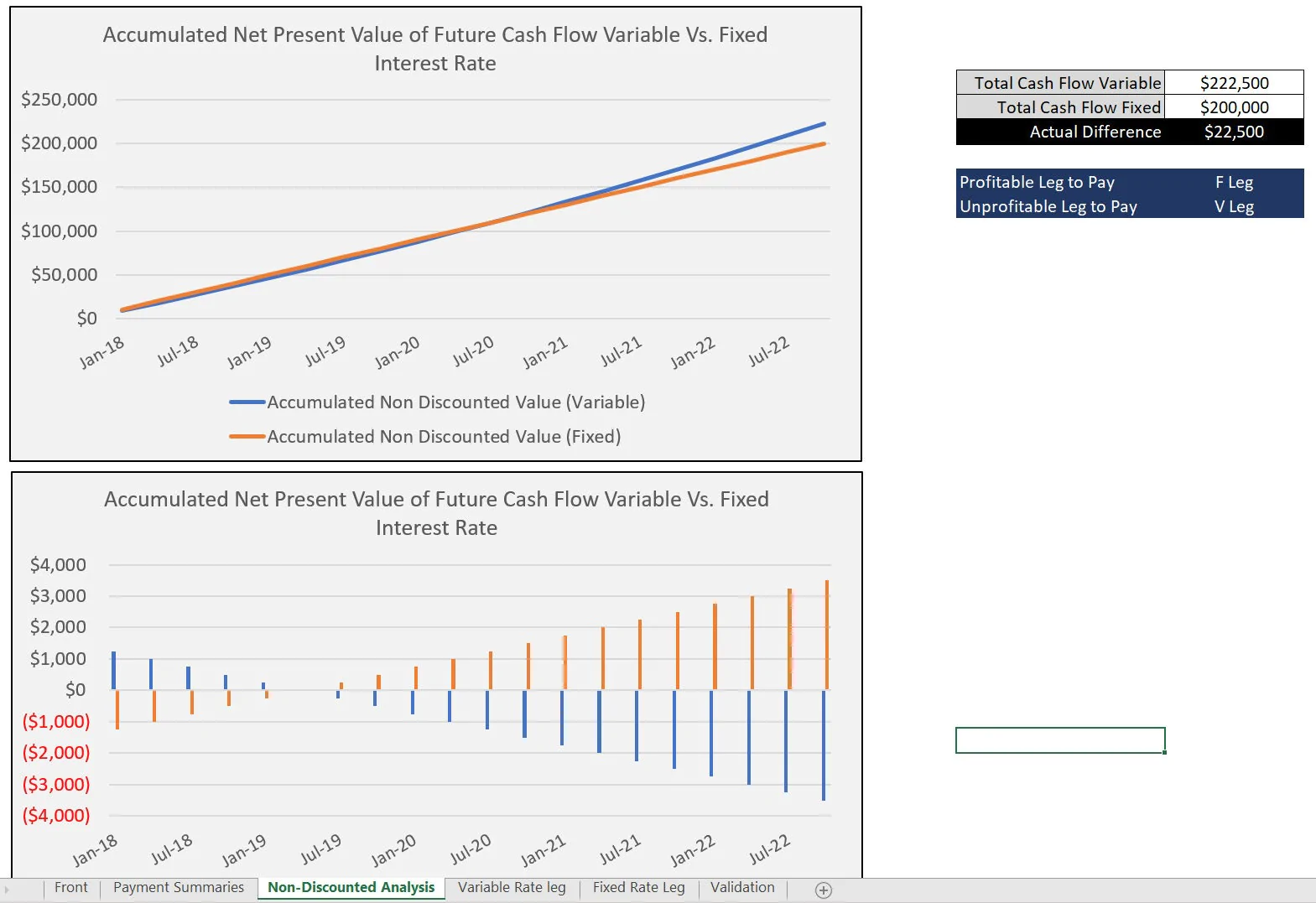

Based on the above inputs, the model will calculate the total and present value of cash flows for each leg and show the value of each leg given the assumptions. There are lots of visualizations that make the results easy to understand over time.

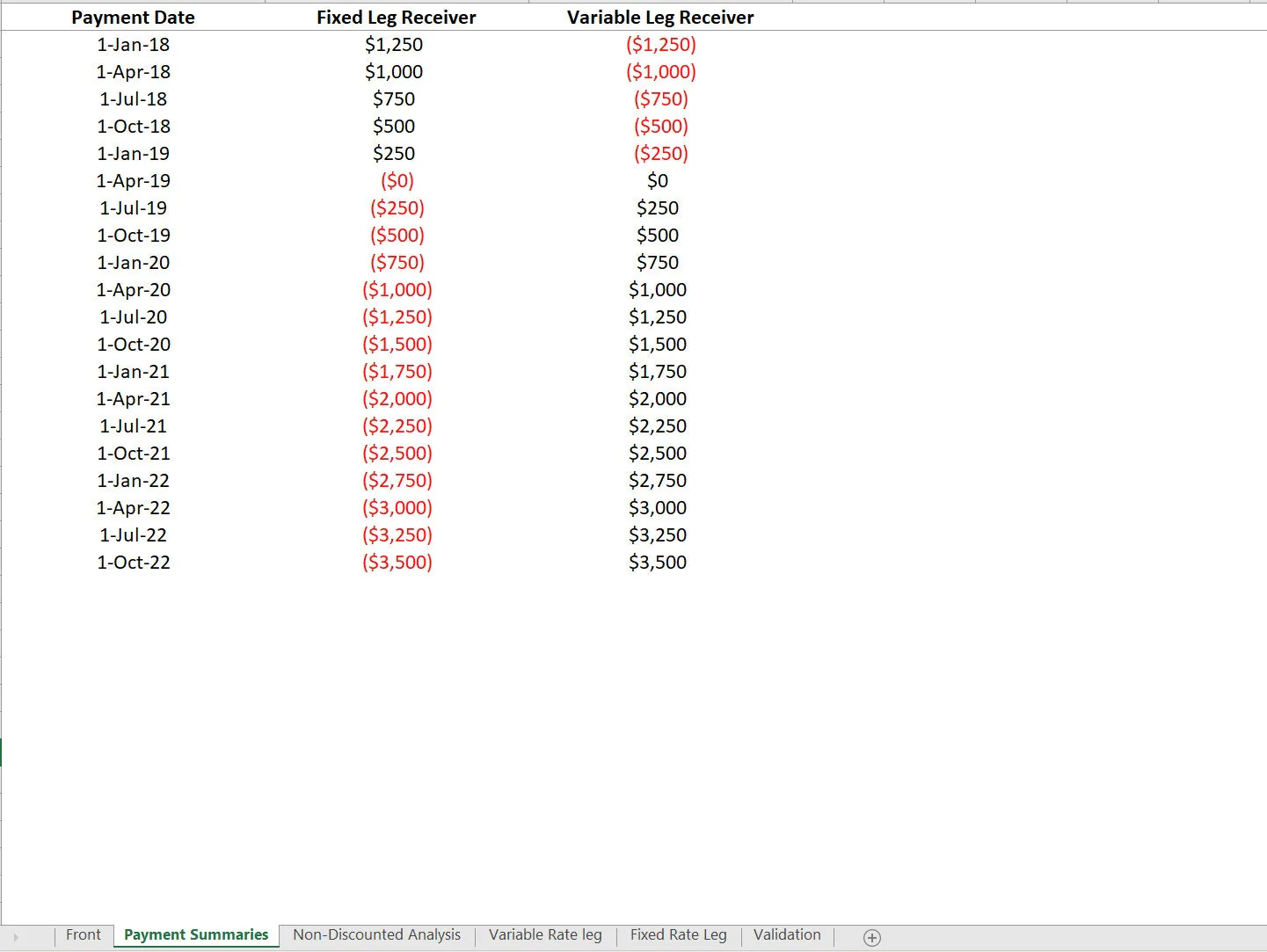

The template includes detailed payment summaries for both fixed and variable legs, providing a clear breakdown of cash flows. Users can also view non-discounted analysis to compare the raw cash flows without the impact of discounting.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Interest Rate Swap Valuation Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

General Valuation

This bundle contains 10 total documents. See all the documents to the right.